Canada Interest Rates Forecast For 2022: The Storm Is Coming!

If you haven’t heard so far there is a big energy turmoil and war around the world. You can reach about it in the perch website where you can find all the recent information about the Canadian interest rates and how mortgages would be affected.

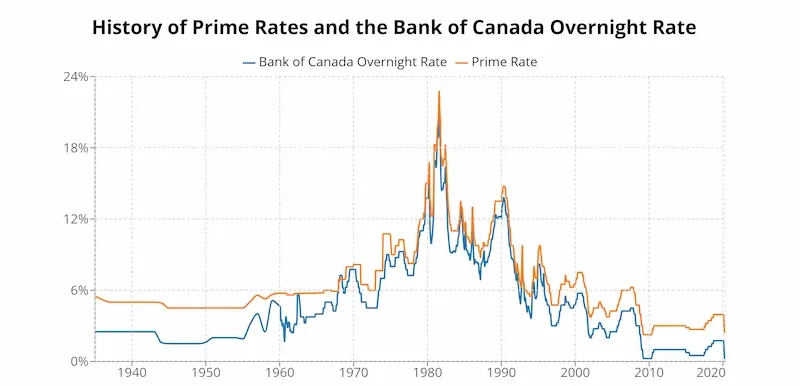

People living in Canada are well accustomed to low interest rates.During the past twenty years the economy was roaring and there was not a single sign that something will go wrong. Not to mention that the strong relations and connections to the US FED system made the Canadian Central Bank a lot less susceptible to volatilities that affect the money supply and the interest rates.

Let’s take a deep dive to the Canadian interest rates forecast for the last trimester of 2022 and how could this influence people who want to buy a house or already have a loan for their home and need to know what their monthly installment would be.

Canadian Interest Rates Reach All Times High

Canadian interest rates will rise to more than 3% later these year as many analyst estimate. It is the only viable way and the sole weapon of the central banks to ease the inflation that slowly rottens the money value. If you want to have a mortgage with fixed interest rate then the best thing to do would be to go to a commercial bank right away and get your mortgage. Otherwise things are going to get a lot worse in the upcoming months for all people who wish to borrow money and get their home.

Today the situation is that the rates are more than 2% for the overnight lending or commercial banks from the central banks. If you add the profit margin the customers will get a mortgage at merely 3.5% rate that is outrageous compared to the traditional 1% that the bank used to charge its clients.

You Cannot Expect A Decent Mortgage Rate For The Next Months

The next month things will go down the hill with energy. Turmoil will be present in all markets. Although Canada is well prepared and has many energy sources for its population, there will be price fluctuations that will rapidly affect the interest rates. For instance, many analysts support that if the oil price goes beyond $150 then we would expect to see some interest rates close to 5%. That is because the inflation will reach record highs and there is no other way to fight against inflation and the uprising prices in almost all goods and services.

Interest Rates For Deposits Are Also Going Up

Deposits will slowly see their interest rates to go up. It’s something that most people who have savings in the bank will see as an extra income coming to their balance sheets every single month. Even though the rates will not reach 5% there is a high chance that time deposits will reach almost a 3.5% rate that is not bad if you thing that the bonds have similar rate for a ten year yield.

That means you will need to wait a few months to buy a new home since you will need to have more savings in your accounts to give you more interest. That way you will be keen on giving a better downpayment for your desired home and even negotiate with the bank for a lower premium at your mortgage.

Mortgage Owners With Variable Rate Would Be Aggravated

Finally, the worst effect of higher interest rates and inflation in Canada is about the homeowners who have received mortgages with variable interest rates.These people were used to have low interest rates and even lower their monthly payment as the interest rate was going down. Now they face great hardships since they can see their monthly payments for the same mortgage going up almost 70% that is outrageous when their income remains the same in monetary values.

The last trimester of 2022 would be a real deal for Canadian banks and there is a high chance to see some of the not bearing up with the new interest rates levels. It is for your best interest to check the rates and ensure that you have the right mortgage or consolidate your loans to a fixed interest rate scheme.